The Dow dropped sharply this morning: The index was down more than 1,000 points at opening bell before recovering later in the morning. The news, following Friday’s 500 point drop, lit up Twitter and news headlines.

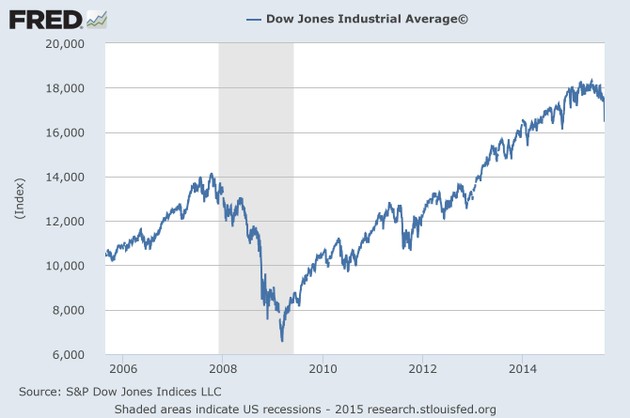

Some economists and commenters have already been pointing to the reasons not to panic. For example, this is the chart of the Dow’s 10-year performance for some perspective:

In these situations, that’s one among many reasons for some smart advice: just don’t watch. Ben Casselman over at FiveThirtyEight has an excellent roundup on why it’s silly to panic—namely that day-to-day moves in the market can be random, and additionally it’s near impossible to know what signal the market is sending. Further, Casselman highlights that less than half of U.S. households own stocks at all.

But what about retirement savings many people hold in the form of 401(k) plans? That depends on how long you’ve got before you plan on retiring. For people close to retirement, a market crash can severely set back plans. But for those whose retirement is decades off, their holdings have time to rebound. One study showed that even those who invested right before a stock market crash recovered their losses within a few years, or, as is the case may be today, perhaps even faster: By noon, the Dow had recovered to being down 150 points.

Nobel economist Robert Shiller says for ordinary investors, the wisdom is that it’s never bad to save more for retirement. When markets are high, it’s easy to overestimate one’s retirement savings. But when the markets are low, the right thing to do is to not panic, and just keep saving.

According to behavioral economics, watching the stock market fluctuations too closely will inevitably cause more bad feelings than good ones, as people feel much worse about losses than they feel good about gains. So just relax, let these guys handle it, and wait for the headlines change.